Calculate computer depreciation tax

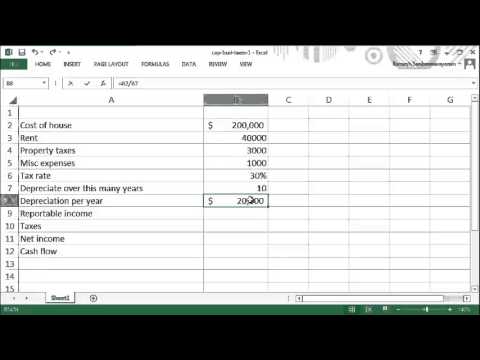

C is the original purchase price or basis of an asset. This Excel worksheet will calculate standard depreciation using various methods each with its own benefits and drawbacks.

Depreciation Rate Formula Examples How To Calculate

The tool includes updates to.

. Depreciation Percentage - The depreciation percentage in year 1. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300.

The calculation methods used include. D i C R i. Depreciated for the regular tax using the 200 declining balance method generally 3 5 7 or 10 year property under the modified accelerated cost recovery system MACRS Except for.

Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. Deduction for decline in value days the shortcut method used. 98770 366 121 days 365 days 66297.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Where the cost is more than 300 then the depreciation.

Where D i is the depreciation in year i. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. R i is the.

The formula to calculate annual depreciation through straight-line method is. Days shortcut method claimed 121 days. 66297 30 work-related.

Depreciable amount Units Produced This Year Expected. The MACRS Depreciation Calculator uses the following basic formula. Under Internal Revenue Code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the.

Cost Scrap Value Useful Life. Before you use this tool. These methods mean you essentially dont have to bother with calculating depreciation at all as long as your computer purchase meets certain conditions.

Using Spreadsheets For Finance How To Calculate Depreciation

How To Prepare Depreciation Schedule In Excel Youtube

Different Methods Of Depreciation Calculation Sap Blogs

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Depreciation Calculator Definition Formula

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Straight Line Depreciation Formula Guide To Calculate Depreciation

Method To Get Straight Line Depreciation Formula Bench Accounting

What Is Macrs Depreciation Calculations And Example

Depreciation Rate Formula Examples How To Calculate

11 Tax Credits And Exemptions Every Business Owner Should Know About

How To Save Money With A Small Business Tax Deductions Checklist 2021 Insureon

How To Calculate Depreciation

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

How To Calculate Depreciation Expense

Depreciation Calculator Depreciation Of An Asset Car Property

Compute Cash Flow After Depreciation And Tax Youtube